Full excerpts of the Markets Issue are available with a two+ week delay to Forum members. Below are select excerpts (with a one+ week delay):

July 27: “If you look at a 5 year running average of US productivity (line on top chart), you will see that the 45 year peak is in 2004. Not uncoincidentally, 2004 is also the year Facebook was founded. I’m not saying apps like Facebook, YouTube, Instagram, Candy Crush, etc don’t have their uses. But c’mon! We all know at least a dozen people who spend waaay too much time doing stupid stuff on their phone. You can be at a social gathering or dinner (you know – an event where you are actually with other live human beings), and they are sitting there looking at their phones. So for every one app that actually adds to “productivity”, there are at least two with10x times larger usage that kills “productivity.””

July 20: “Yellen seems to think that the effects of a stronger dollar are transitory. But if you look at the list of our top five trade partners, it’s not clear how the US economy would benefit from the following (and most of the situations look like it may take a while to resolve). We are not an island.

o 1) Canada. They eased rates last week. It’s a little strange for one closely-tied neighbor to be easing while the other is thinking about hiking.

o 2) Mexico. No real news. But with Trump leading the Republican nomination and El Chapo escaping prison, it wasn’t a good news week for Mexico.

o 3) China. China added up to 3 trillion yuan to support its stock market. I’m not sure why this move would be necessary when their economy is doing so well, with GDP at 7% and retail sales at 10.6% yoy. Eh hem. China will be an ongoing story.

o 4) EU. Greece accepted the new austerity plan to get more money. Talk about beating a rented mule! Greece will be an ongoing story.

o 5) Japan. The BOJ had to trim growth and inflation projections. This story sounds familiar. Japan will be an ongoing story.”

July 13: On Greece: “A bad deal is worse than NO deal. If any form of this deal goes through, you can be sure we’ll have another (bigger) problem within a few years. In my mind, the only real long-term solutions are reform plus: (1) default, (2) 40% write-down of existing loans, or (3) permanent selling/ceding of territory. Greece just has too much debt! Some austerity measures could have the effect of actually lowering revenues.”

July 6: “Chinese equities were down another 12% last week. It’s interesting to be concerned about a stock market when it’s still up almost 90% in the past year. But I fear the mom and pop middle class could be eating the brunt of this selloff. I am getting a flashback to Apple’s last earnings report where they announced that China iphone sales topped US sales. The rich are going to get their 9-hour Apple watch. It’s the little guys who get their disposable income crushed in the stock market who may forego such purchases.”

June 29: The state of title loans “highlights the problems with the banking system, and how there is no impact to those with low incomes. So someone with collateral wants a loan (for like 25% of the value of the car), the Fed has rates at “zero,” the market clearing rate for these loans is 300%, and no bank wants to touch these loans! At the same time, people are screaming that they can’t earn more interest on their fixed income portfolio (especially retirees). If only there was some kind of intermediary that could take investor’s money at some absurdly low rate, and use that money to lend to other people in the community who need the money (for hopefully some productive use), and capture a reasonable spread in the middle. Let’s call this fictitious institution a “bank.””

June 22: “The main bullet point is that the Big 3 (Yellen, Fischer and Dudley) appear to be solidly in the “1 hike in 2015” camp. As previously mentioned: “More importantly, 4 of the 7 members who were at 2 hikes by year-end, dropped to 1 hike. This brings the total thinking 1 hike by year-end to 5. My over/under on the number of {Yellen, Dudley and Fischer} being in these 5 dots is 2.5 (i.e. two an of half of the Big 3 are thinking 1 hike this year). This makes the case for September look weak. But we are data dependent.” … I find it funny that liftoff is supposed to happen this year, and the forecasts range from one to eleven 25bp moves by the end of next year. Hmm… anywhere from 1 to 11 hikes by the end of 2016, you say? It’s particularly funny if you consider there are only 12 Fed meetings until the end of 2016. Since these are supposed to be “central tendencies,” it’s only right that they excluded the border scenarios of 0 and 12 hikes. Thanks for the clarity.”

June 15: On the growth of the Hispanic population: “any time you have an increase in a less wealthy part of the economy, unless there is a structural change within that demographic, you should expect to see some not-so-favorable impacts. So having more skilled older workers retire and be replaced by a lower income group is not a favorable trend for the economy as a whole.”

June 8: “The Gamma Signal came through strong to the downside. The markets had obviously gotten too complacent about long fixed income positions. Playing the gamma signal via compressed curvature trades was very good risk / reward.”

June 1: “Bloomberg had an article out asking what would happen when a generation of traders has never seen a rate hike. Gundlach said something similar a while back. It’s not clear to if this is such a huge disadvantage, because the circumstances around the previous rate hike were so different to the current one, that I’m not sure if it is any kind of “advantage” to have been around. Typically, the people who are most likely to get smoked in a hike are those who have made a career out of selling vol the past 5+years. But it’s not like the market is going to start pricing in 50s, or the Fed hiking every meeting, as in the last cycle. And if they have never been through a hiking cycle, they are more likely to look at historicals, which would probably overstate the magnitude of a potential rate move in the current cycle… Except…”

May 25: “One thing I wanted to add was that I don’t see why the Fed should be concerned about the “taper tantrum” reaction. If you were concerned that a 100bp selloff (from these relatively low levels of rates) in the long end would crush the recovery, maybe you shouldn’t be hiking at all? Especially when there is no sign of inflation? All other things being equal, if they factor in this little bit of game theory with the markets, this may cause the Fed to want to be a little more patient.”

May 18: With regard to decreased labor force participation for those under 25 and increased participation of those over 55: “This is mostly conjecture on my part (as I do not have access to the relevant data). My goal is just to provide some food for thought:

• Older people are probably less likely to file for Jobless Claims…

• Older people are probably less likely to contribute to Retail Sales…

• This could also explain why the savings data has been high in PCE…”

May 11: “Even if you are not a fan of June, a lot of economists still have September for their liftoff forecast. The 6.4bps currently priced into the Sept meeting would be fractionally close to offering you the magical 3 to 1 risk reward that traders are always looking for. You also have FOUR payrolls between now and the September meeting. You need the UR to fall 0.75percentage points per month for us to get to the middle of the Fed’s central tendency. The average is 0.83pp per month since 2013. ”

May 4: “But if you take a step back and think about what is optimal for a society, is the solution really to have each new young worker start their career in a $200+K hole, with a degree that may not help them land that “great” job? People have done some estimates where degrees from some colleges end up costing the student over $150K in lifetime expected value. The number of colleges that result in negative lifetime expected values will only increase over time, as tuition continues to increase and wages continue to stagnate.”

April 27: “I had mentioned that this hiking cycle is going to be different from the previous hiking cycles (especially 2004-6) for several reasons:

• The Fed is not going to be measured…

• The Fed may hike despite the low inflation backdrop…

• The Fed may hike despite the low global growth backdrop…

• Remarkably, several Fed members actually admitted they may have to ease after a hike.”

April 20: “What are the implications of a decreasing (and aging) population? GDP should be lower… Retail Sales should be lower… Inflation should be lower?…”

April 13: “An interesting way to brainstorm a good online business idea is just to think about which jobs are high paying with relatively less “ability” required, and find a way to replace the business with technology. Whether it’s Progressive (bye bye insurance broker), the myriad of online loan companies (bye bye bank officer and underwriter), or the latest trend of investment apps (bye bye financial advisor), technology is becoming a friend to the consumer, but an enemy to the (upper) middle class.”

April 6, 2015: “It’s really strange to have a central bank say they will hike by year-end and have the largest year spread be only 67.5bps – especially when they think the long run rate is 350bps away. But I suppose this could happen when you have the Chair wanting to hike by year-end, ignoring the actual inflation data and the global stagnation around us.”

March 30, 2015: “Yellen had some interesting things to say in her speech on Friday afternoon. If you have time, it’s a pretty good read (as far as economic speeches go): http://www.federalreserve.gov/newsevents/speech/yellen20150327a.htm

In case you need the Cliff’s Notes version, see the next section on my FOMC thoughts.”

March 23, 2015: “Year flies centered in the back reds and front greens declined 6.75 bps on the week – that is why I referred to them as “toxic waste.” As mentioned before, this hiking cycle is unlike the previous one – the Fed is not going to be “measured” and the Fed seems to want to hike even with low inflation (increasing the odds of a double dip). This is not a scenario that is conducive to a robust hiking cycle or an environment where you want to own high flies on that part of the curve.”

March 16, 2015: “Now that the Fed may start raising rates, and as early as “mid-year,” it makes sense to take a look into what is priced into each of the Fed meetings for the rest of the year (see table on right).” I will start discussing Fed meeting probabilities on a regular basis.

March 9, 2015: “we are in the middle of an interesting multi-decade structural change in consumption. Going from a home-cooking economy to an eat-out economy has a number of interesting ramifications”

March 2, 2015: The “My big takeaway from the week’s Fedspeak is that all signs point to higher yields in the long end.” [regarding Greece’s 4 month extension] “Negotiations 101 says that if you have a positional advantage, it should benefit you to wait until the last minute. Expect this to go on until very very late June. There is a Fed meeting June 16-17. This puts the hurdle for a June move slightly higher [all other things being equal].”

Feb 23, 2015: The “Fed Minutes were more dovish than I was expecting (see the Appendix for the full email I sent out Wednesday). I was expecting something a little more “balanced,” since (employment) growth is strong and inflation is weak. However, the tone and nuggets were dovish. In particular, the concern over “patient” implying an “unduly narrow range of dates” implies a longer intended mean time from the removal of “patient” to the first hike. Of course this may also mean they would like to take out “patient” earlier rather than sooner.”

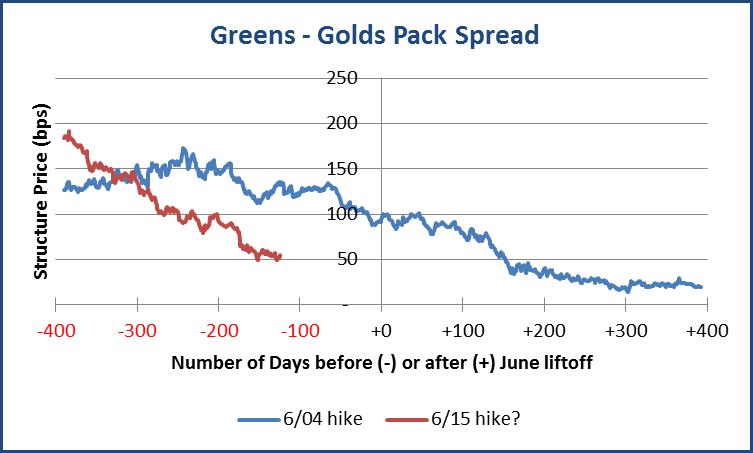

Feb 15, 2015: “…consider the last argument for liking greens-golds flatteners. The graph on the right shows the greens-golds pack spread in the last hiking cycle, as compared to this hiking cycle. The most optimistic case (a June 2015 liftoff) was assumed. The x-axis shows the number of days before (“-“) and after (“+”) liftoff (“0”). We haven’t been this flat since about 4 months after the 2004 hiking cycle, and the markets don’t even think we’re 50% to hike 25bps in June! There are some who still think hikes are a year away.”

Feb 15, 2015: “…consider the last argument for liking greens-golds flatteners. The graph on the right shows the greens-golds pack spread in the last hiking cycle, as compared to this hiking cycle. The most optimistic case (a June 2015 liftoff) was assumed. The x-axis shows the number of days before (“-“) and after (“+”) liftoff (“0”). We haven’t been this flat since about 4 months after the 2004 hiking cycle, and the markets don’t even think we’re 50% to hike 25bps in June! There are some who still think hikes are a year away.”

Feb 8, 2015: I give an explanation of why the second hump on the butterfly curve around U7 seems to be misguided: “there are now four ways you can make money fading that second hump around the end of 2017: (1) the Fed ends up only hiking to 1-2% (so no need to hike in 2017), (2) the Fed needs to jack up rates in a hurry (so no need to hike in 2017), (3) a turn of events takes all hikes off the table (so less need to hike in 2017), (4) the Fed hikes, but it is perceived as a colossal mistake (so EASES priced in 2017). When I liked being short Z7 towards the end of last year, it was because I thought the Fed was going to be more patient than they ended up being. So item (1) would have been good for me (if they waited a year), and items (2) and (3) would have been non-issues. If the Fed is actually going to hike this summer, there are fewer ways to make money betting on increased curvature around U7 relatively. I’m not saying there isn’t room for that fly to get higher – because there is. Since rates are low, the flies are still at low levels. As rates get higher and the curve gets steeper, the flies would probably increase. I’m just saying, relative to how flat the curve still is, the fly around U7 looks to be a good fade (and this is the point of Trade 66, and Trade E4 – owning steepeners vs fading that fly). Because we could easily steepen the front of the curve with that fly doing nothing. Unlike 2004, if the FOMC is not going to go “measured,” you need to discount some of the second and third year hikes, in the face of the global headwinds, as an extended pause is possible.”

Feb 1, 2015: “I do not think Bullard’s view represents the consensus. Clearly he had some part in the growth upgrade in the FOMC statement. But he does not seem like he would have argued strongly for elaborating on the inflation picture, or adding “international developments.” So that means a number of other members would have had to have argued for it, and in particular, Yellen, Fischer, and/or Dudley – and those are the voices that matter most.”

Jan 25, 2015: “Our top 5 trading partners have all eased rates or started a QE program in the past 8 months. (1) Canada just eased, (2) China eased last month, (3) Mexico eased last summer, (4) the EU just announced a QE program, and (5) Japan started a QE program 3 months ago. Apparently, no one else is showing up to our “recovery” party. In fact, everyone else is throwing an opposite, “Oh no! Not again!” party. This reminds me of a line from John Donne: ‘No man is an island entire of itself; every man is a piece of the continent, a part of the main.’”

Jan 18, 2015: “It is now becoming apparent to me there is at least one algo/bot trading the curve based on vol. One massive algo, or a bunch of smaller ones that proliferated. I suppose various algos have been around for a while, but many of them have operated on a scale where it was not as noticeable. However, this linear pattern on a 50bp rally this year is absurd [see graph]. That ratio of 1.5:1 also happens to be same ratio of volatility in 0EH vs 2EH. So it feels like something along the lines of “keep the contracts in-line in relation to the volatility surface” algo, where you buy/sell the contract that is noticeably sticking out in relation to the vol surface, and sell/buy the one that isn’t. You job enough P&L trading the ranges tightly to make up for being wrong once in a while. Now I’m not saying we didn’t have some weird crisis flows, or that we aren’t in a “hiking” environment (!) that may keep the fronts more offered. But this lateral linear move is very atypical for this structure. Unfortunately, this means having to wait until something happens to “break” the algo – like a Fed meeting where they do something unexpected. But I don’t see what’s going to cause this to change – the “oops” event may not occur until March or later. There just isn’t enough information now for the FOMC to need to change anything (especially at a non-press-conference meeting).”

Jan 11, 2015: “[The Fed’s] own actions have caused tens to rally even further. Rather than sticking to “we’re going to let the economy go until core PCE gets over 2%,” they opted to let it be known that they could hike even if inflation was noticeably less than 2%. Core PCE was 1.6% in November, so presumably they could hike with inflation still that low, as long as they were “confident” we could get to 2%. C’mon. 1.6% is nowhere near your benchmark! And all this is with downward risks to (global) growth and inflation. Give me a FOMC that’s willing to let inflation get to 2.5% in the face of strong economic data, and I’ll show you a ten year yield with a 3 or 4 handle. If you want the ten year yield to go higher, you have to at least give the impression you are not going hike prematurely and crush the recovery.“